The cost of living and its impact on the digital shelf

September 21, 2022It's a hectic time for brands managing their products on the digital shelf. Let’s dive into the cost of living crisis, what it means, and how brands can use PIM to build for e-commerce success despite market uncertainty and a more selective consumer base.

Consumers are anxious, thanks to an uncertain economy, runaway inflation, and the cost of living crisis. Rising prices impact buyer behavior in several ways, from buying in bulk to postponing planned purchases to cutting back on purchases and saving more now.

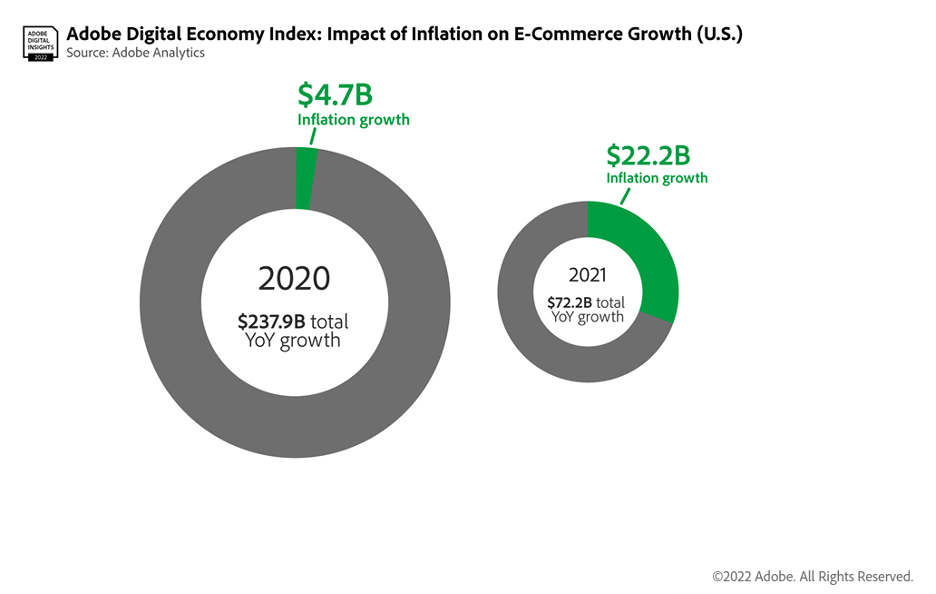

Ecommerce, especially, is feeling the pinch. After nearly a decade of declining prices and rapid growth, ecommerce prices are up 3.1% year over year, according to the Adobe Digital Economic Index. In 2020, inflation contributed just under 2% to the growth in ecommerce sales; in 2021, that figure jumped to 31%. That’s 29% in just one year.

It’s a tumultuous time for brands managing their products on the digital shelf. Let’s dive into the cost of living crisis, what it means, and how brands can use PIM to build for e-commerce success despite market uncertainty and a more selective consumer base.

what is the cost of living crisis?

A cost of living crisis occurs when the cost of necessities like food, energy, clothing, and shelter rises faster than household income. Disposable income shrinks as people devote more and more of their paychecks to simply maintaining their standard of living.

The global inflation rate is currently about 7.5%, but countries like the US, the UK, and Brazil see rates in the 9% to 10%+ range, and they are predicted to go even higher (LINK?) And even though wages have increased slightly over the past year, the increases aren’t keeping pace with inflation. In the US, real wages were down 3.5% in July 2022.

To put it simply, even though people are earning the same as they were a year or two ago, it feels like they are now earning less because they have to pay more for their living expenses. There’s less money left to spend after they’ve paid their bills, and what the money they do have buys less because inflation has eroded their purchasing power. Is it any wonder that JPMorgan’s economists predict a 10% drop in discretionary spending this year? The math just doesn’t add up.

what’s causing the cost of living crisis?

Much of the issue traces back to the pandemic, but not in the ways you might imagine. Government stimulus programs designed to combat the effects of lockdowns put money back in people’s pockets, and once economies opened up again, demand for goods soared.

Unfortunately, global supply chains, still laboring under the effects of the pandemic, weren’t able to keep up with demand, leading to inflation. China’s COVID policies have also exacerbated the problem. China is a major producer and consumer of international goods. But, the country’s zero-COVID policy meant major ports in Shanghai, Shenzhen, and Guangzhou could not handle their normal freight volume, leading to major global supply chain bottlenecks.

And the war in Ukraine has disrupted the global energy supply. Energy prices soared and are still soaring, especially in many European countries. So, of course, rising global energy costs drive up the cost of all goods, furthering the vicious inflationary cycle.

how are consumers’ buying behaviors changing because of the crisis?

With inflation at 40-year highs, consumers are making substantial changes in how they shop. A recent Ipsos poll showed 80% of consumers said inflation had impacted their shopping habits in the following ways:

- Buying more/stockpiling items on sale or special promotion

- Switching to a cheaper brand, a store brand, or a private label brand

- Buying smaller quantities

- Shopping more at mass merchandisers or club stores

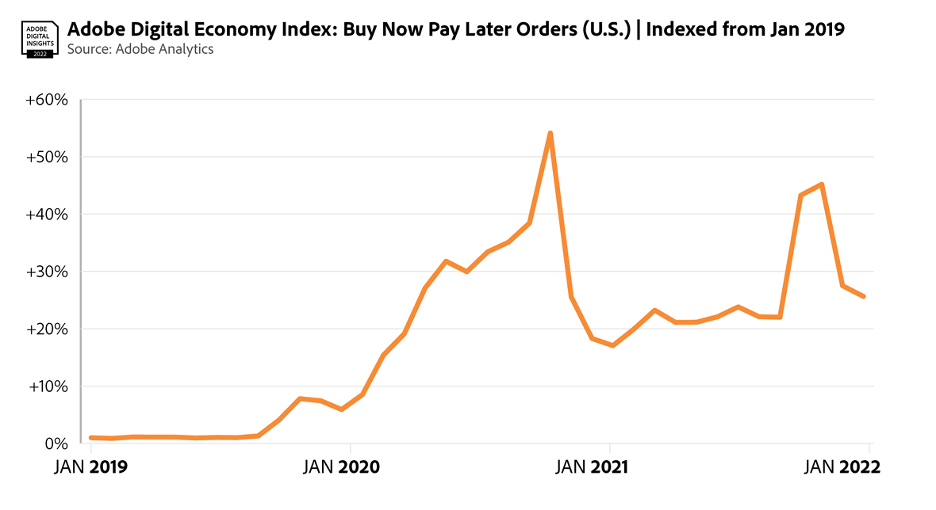

The tremendous growth of buy-now-pay-later which began during the pandemic shows no signs of slowing down. Budget-conscious consumers are spreading out payments for discretionary purchases to stretch their dollar. According to Adobe, BNPL revenue is up 323% over 2020.

Shoppers have become more selective – and rightly so. Inflation is shifting the focus for consumers away from price and toward value. What if the product’s price is not aligned with the product’s perceived value to the consumer? In that case, they will “trade down” or switch to another product entirely, especially if the new product is in stock and available for quick delivery.

Brands that successfully manage both their pricing and promotion strategies and their stock availability across the digital shelf stand the best chance of attracting and retaining loyal customers. What’s better than providing your customer with confidence they are buying the product they need? Even the most selective of consumers can’t argue that.

what is the digital shelf?

The digital shelf is the online version of a physical shelf in a brick-and-mortar store – only broader. It includes all the digital touchpoints a consumer might encounter while searching for, evaluating, and ultimately purchasing a product.

Product content is the main source of contact for consumers browsing the digital shelf. Because consumers can’t see or physically touch your products on the digital shelf, your product content has to easily show everything they need to make a purchase decision. That includes product details, sourcing, price, availability, delivery options, ratings and reviews, and return policies, to name a few. Ensuring all your product information is complete, accurate, and up to date are key challenges of selling on the digital shelf. Digital shelf monitoring plays a crucial role in addressing these challenges by continuously tracking and optimizing the visibility and accuracy of your product content across all online touchpoints.

That’s where PIM (product information management) solutions come in. PIM centralizes your product information and automates the processes for managing it and distributing it across all your digital touchpoints.

what is a PIM solution?

A PIM solution is software that serves as a single source of truth for all your product information. It simplifies onboarding and integration of product data from multiple internal and external sources so you can create, contextualize and optimize your product stories. Once your product content is ready for the world, PIM makes it easy to deliver across all your channels.

The best PIM solutions incorporate digital shelf analytics (DSA). This capability monitors your digital shelf touchpoints in real-time to give you actionable insights on the performance of your product content, wherever it is online. DSA not only helps you maximize product visibility to your customers, but it also helps you keep your pricing and promotions competitive across multiple platforms while letting you stay on top of any availability issues that may occur.

how can PIM help my business during the cost of living crisis?

AI-powered smart search technology is fast becoming a must-have to thrive in digital commerce. With digital shelf analytics, brands have data-driven insights that enable them to eliminate the guesswork. Engagement intelligence The cost of living crisis isn’t only affecting consumers; it’s causing chaos for retailers and manufacturers who sell on the digital shelf. Managing supply chain risks and adapting to changing consumer behavior requires an agile approach to product information. PIM gives you the power and flexibility to move quickly and capitalize on new opportunities.

- PIM enables robust inventory management. PIM gives you a 360-degree view of your product inventory. You can keep tabs on what’s moving and what’s not so you can manage your content to prioritize SKUs. It also helps you monitor all the links in your supply chain to stay ahead of bottlenecks impacting availability.

- PIM helps build supply chain transparency. A recent study showed 83% of companies suffered reputational damage due to supply chain disruption over the past two years, costing large companies an average of $184 million a year. PIM provides a single source of truth to share information with all stakeholders in your supply chain. With real-time visibility, you can take steps proactively to manage supply chain risks.

- PIM supports agile pricing and promotions strategies. In a cost of living crisis, consumers want to know they’re getting the best value with every purchase. PIM with DSA helps you monitor competitor pricing and stay up-to-date with promotions. You can even use DSA insights to see how a competitor’s promotions impacted your sales so you can adjust your strategies if needed.

- PIM improves product availability. Since the pandemic’s start, consumers have received over 59 billion out-of-stock notifications, according to the Adobe Digital Economy Index. Consumers are quick to switch brands when a preferred product is out of stock, and cost-conscious consumers are even more likely to switch when they find a product offering better value. With PIM, you can stay on top of stock levels and fine-tune your strategies to avoid stock-outs and delisting. Even better, DSA alerts you when a competitor is out of stock so you can move quickly to capitalize on those opportunities.

Building success on the digital shelf is hard enough in the best of times. But when uncertainty grips your supply chain and consumers are pulling back on spending due to rising living costs, it’s even trickier.

That’s why having a PIM solution gives you the tools and insights you need to adapt your product content and ecommerce strategies to meet the changing needs of your customers – and set the foundation for modern success.

you may also be interested in…

author

Joakim Gavelin

VP Digital Shelf Services

Joakim has over 25 years experience in people, sales and business management, helping brands and business increase their presence, sales and profit. With deep knowledge in retail sales and intelligence to consumer behavior to global sales, he is familiar with both B2C and B2B - no matter the size, industry or location of company.

read more